Why Should I Invest at All?

Why Should I Invest at All?

This is a fair question that I think everyone should think about. So let’s think about it now:

- Do you want to invest for your retirement?

- Are you investing for your child’s college fund?

- Would you like to invest to be able to afford a new home or a vacation home?

- Are you just trying to make more money than the savings account offered by your bank?

Whatever your motives, you are investing to get earn a return on your money, not just a return of your money. All this means is that you want to back more than what you put in. Your reasons why might differ. A few common reasons include the increased cost of living and an improvement in your standard of living. Many of us want to start a family one day, and that will significantly increase our costs. Don’t get me wrong, I am sure the benefits will outweigh the costs, but you’ll probably have a happier family if you avoid financial trouble. I am also quite sure that most of us want to improve our living standard compared to when we were fresh out of school and got our first job. So we invest to get Can we agree that you invest to make a return?

Where Should I Invest?

Let’s look at some options. Many people don’t want to risk losing their money and might choose to just put money in the bank. The issue with this approach is that our money is under attack from inflation. Inflation means that $100 today will be able to buy fewer things ten years from now, i.e. your money will be worth less in the future. Today, savings accounts hardly compensate for inflation. Another very low risk option is to invest in bonds, notably government bonds. A third alternative is to invest in stocks, which is the most risky option of the three.

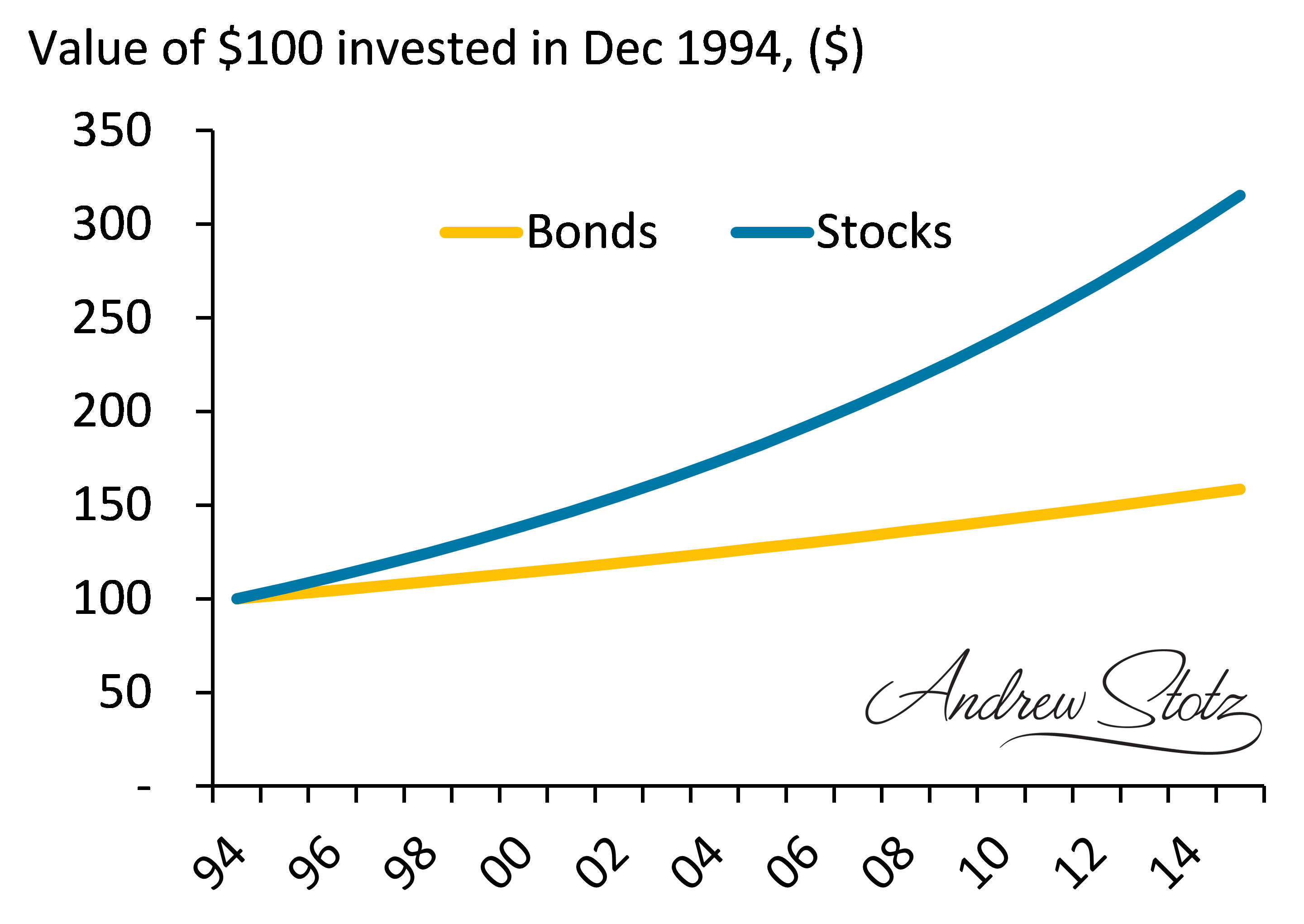

Let’s take a look at the difference, if you had invested $100 in bonds or stocks in December 1994. I’ve used the average return of global stock markets for each year and the average of each country’s long-term government bond rate. I have then deducted the average inflation each year to get the real returns.

During the whole time period, inflation was about 3%, bonds returned 5% and the stock market return was about 8%. A $100 investment in bonds on December 1994 would be worth $159 today. That money would have grown to be $315 if you invested it in stocks. So an investment in stocks would be worth about double an investment in bonds, but bonds would still have increased the value of your investment by 59%. Since bonds are lower risk, you might decide to go with bonds, but there is an issue with that. Remember that you want to make profit – a real profit, i.e. profit after inflation.

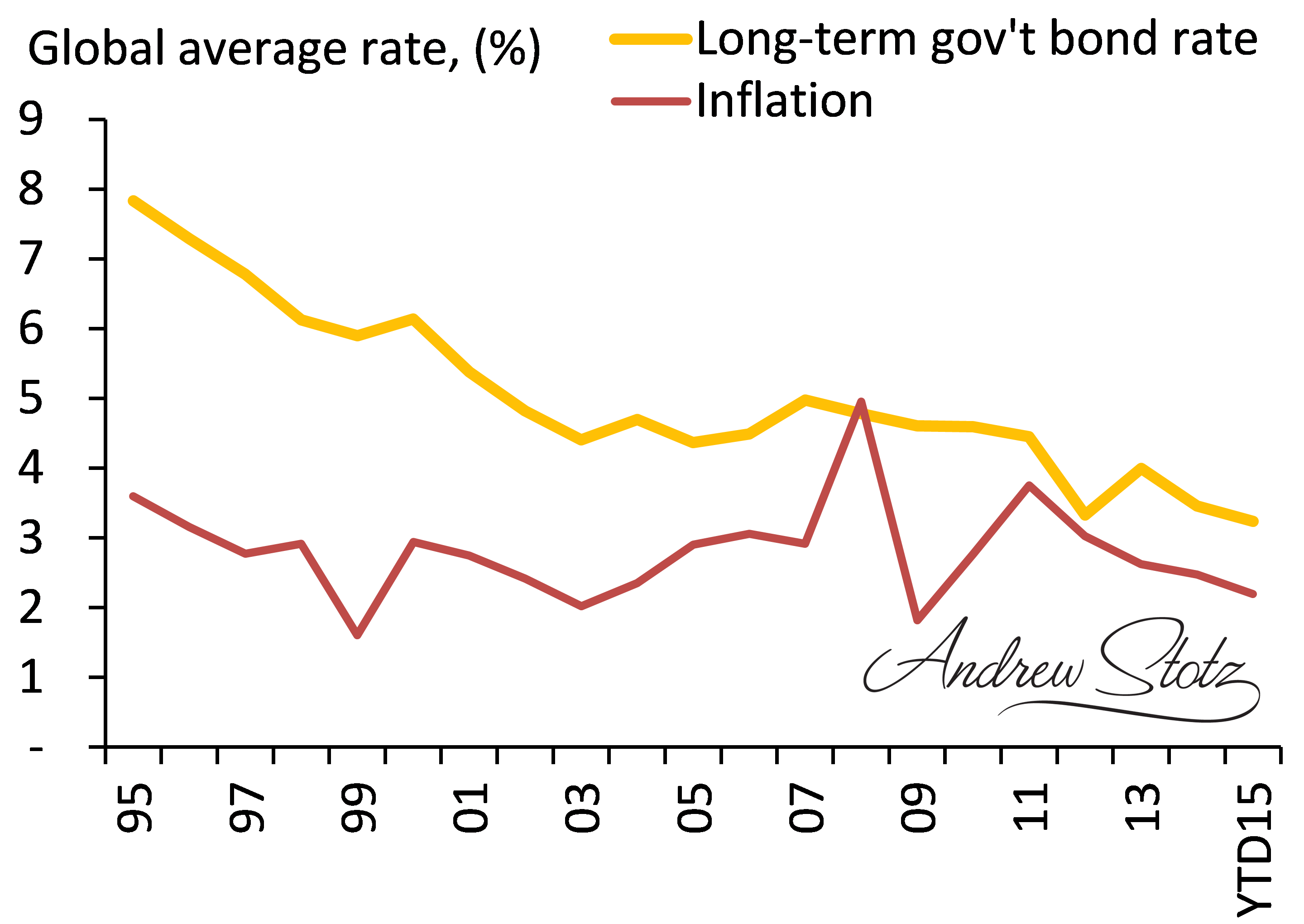

The chart above clearly shows that the average long-term government bond rate has halved in about two decades and today, it’s only 1% above inflation, compared to more than 4% in 1995. The negative trend for bond rates is clear and you should not expect to get the same return in bonds going forward. If you want to invest and make a real return on your investment, no matter what your reasons are, investing in stocks is the way to go. Investing only in bonds no longer seems to be a sensible alternative.