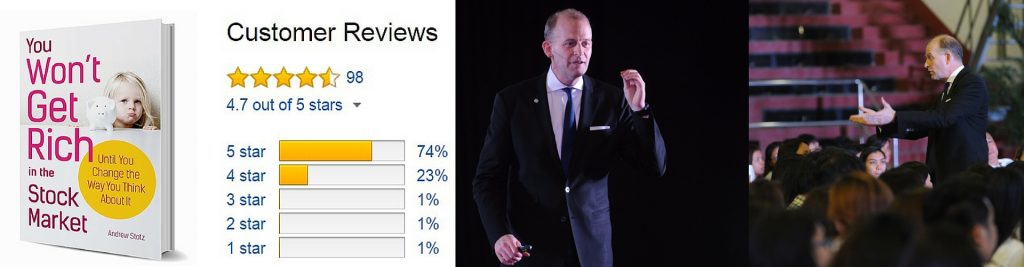

Investment Principles

Why Should I Invest at All?

The Cost of a US University Education

[dropcap background=”” color=”” circle=”0″]U[/dropcap]S University Education for Your Newborn Costs about US$2,000 per Year The cost of a US public university education for a child born today will be about US$80,000. A parent could invest about US$2,000 the year their child was born and increase that contribution by 5% each year to make sure that…

Savings as a Source for Wealth

[dropcap background=”” color=”” circle=”0″]T[/dropcap]here are a number of ways to build wealth. The two main methods people tend to think of are through your career and by investing. Saving money definitely deserves its place in a wealth-building strategy too. No matter how much you make or invest, chances are this is an area of your…

Avoiding Big Investment Mistakes Early On

[dropcap background=”” color=”” circle=”0″]W[/dropcap]hile it’s great that you’ve decided to start investing at a young age, it’s also essential that you avoid some especially big mistakes early on. Some mistakes may be considered part of the learning curve, but you don’t want to make unnecessary ones that can cripple your financial future.

Remaining Realistic about the Stock Market

[dropcap background=”” color=”” circle=”0″]P[/dropcap]utting money in the stock market is always a big step, regardless of what your goals are. However, no matter what you hope to achieve specifically, everyone wants to see their money grow. Unfortunately, too many people aren’t realistic about their expectations. This is an easy way to end up disappointed, but…